Welcome, Lincoln Labs

Enjoy convenient banking and exclusive perks while being part of a member-first community.

Who can join?

As an MIT Lincoln Labs employee, you work for one of our partner associations. That means you, your family, and your friends can become members.

Plus, our on-site branch location makes banking even easier—all while being part of a community that puts people first. Get personalized guidance from a team that understands your unique needs. Achieving your financial goals has never been more convenient!

What we offer

As an employee at MIT Lincoln Labs, you can enjoy exclusive credit union perks right in the heart of Hanscom Air Force Base. Enjoy lower loan rates, higher dividends on savings, and member-only offers designed to create well-being and support your financial success.

Checking & Savings

Manage your day-to-day banking and save for that dream purchase.

- Checking benefits

- Tiered Savings options

- Certificates of Deposit

Lending

Get the financial assistance to achieve your long-term goals.

- Personal Loans

- Auto Loans

- Student Loans

Home Loans

Everything from buying your first home to refinancing your equity.

- Mortgages

- Home Equity Loans & Lines of Credit

Convenient banking, right where you work

Located on-campus, our Lincoln Labs branch makes it easy to manage your finances between meetings or during your lunch break.

Get personalized guidance and speak directly with a member experience representative. Stop by our ATMs to make deposits, withdrawals, or transfers with account assistance on the spot.

Certificates

Rates as high as

3.50% APY1

Learn moreMinimum daily balance required to earn APY is $500.00.

Begin with a savings account

A savings account (called a savings 'share' account) with a $5 minimum balance is required to establish and maintain membership. That $5 represents your ownership share in the Credit Union because once you become an MIT FCU member, you also become an owner.

To open you will need:

- Social Security number*

- Driver’s license or government ID

- Current home address

- Credit card or bank account and routing number to fund your account

Note: You’ll need these for any joint owners you’d like to add.

*If you don't have a social security number, you can still apply.

Benefits for the whole family

Immediate family such as parents, siblings, children, grandparents, spouses, and those living in your household can become members. This means your loved ones can enjoy the same great rates, personalized service, and financial benefits that you do.

Financial Wellness

Our Financial Wellness Blog offers practical tips, insights, and guides to ensure you’re taken care of every step of the way. To us, financial wellness goes beyond the numbers. We provide the tools and knowledge to reduce stress, build confidence, and foster smarter financial decisions.

The Credit Union Difference: The History of Credit Unions

Learn about the differences between credit unions and banks.

Read more

The Importance of Being Financially Fit

Are you ready to stretch those financial fitness muscles? We hope so, because it’s time to get financially fit!

The Importance of Credit Health

Everyone should make a habit of reviewing their credit health regularly. Here's why.

The Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

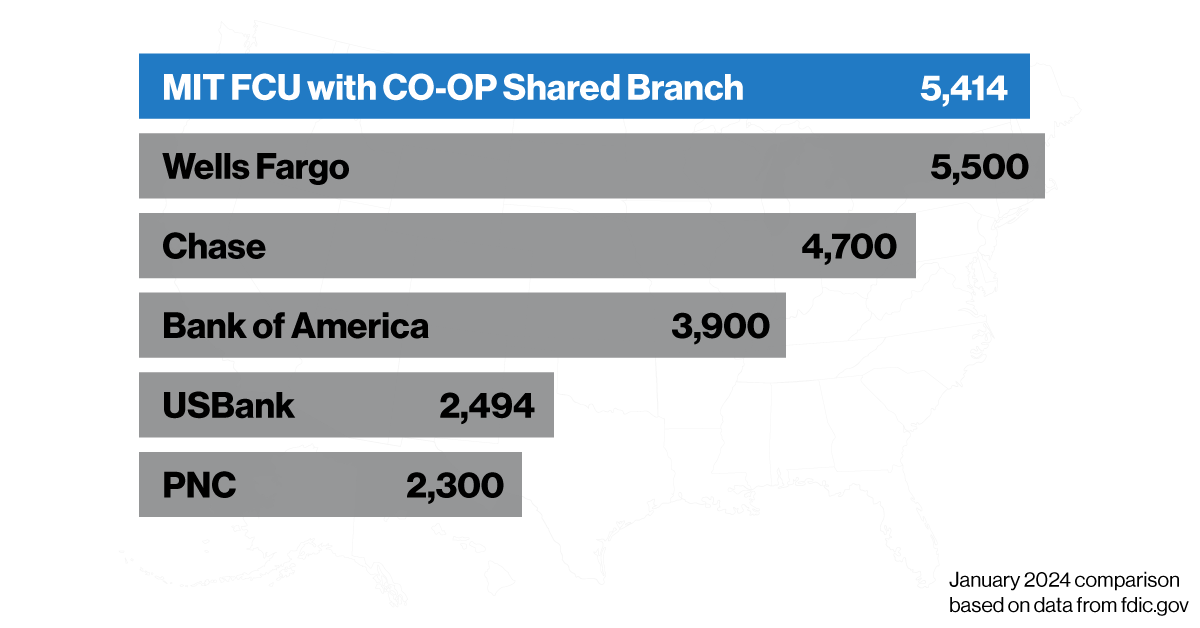

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

Bank when and where you want

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4