Introducing the next generation of digital banking

Whether you’re at home or on the go, banking with MIT FCU just got easier than ever. Our redesigned digital banking platform will make navigating your finances easier, faster, and personalized to you.

Here’s what's new:

- Customize which features appear on your homepage - collapse, expand, and reorder your widgets at any time.

- Refreshed mobile check deposit platform - enjoy a simple, quick and secure process for your deposits.

- Personalized messaging - see your key messages upfront and customize the name you're greeted with.

- Easy access to activity history - view your most recent transactions without having to click into account history.

Unlock the power of mobile banking

Account monitoring

Check your balances and transfer money between accounts.

Check Deposit

Capture an image of your check and deposit it directly into your account.

Card control

Access card digitally, set controls and alerts, report lost or stolen, and turn card on/off.

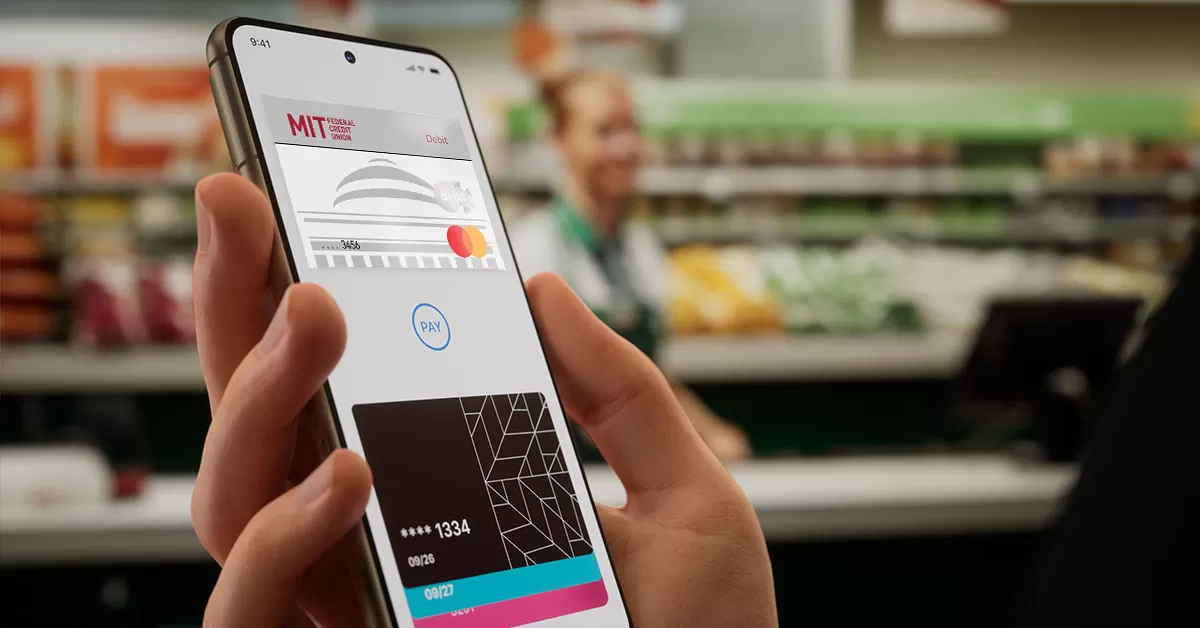

Security and convenience at your fingertips

Speed up the checkout process– add your MIT FCU card to mobile wallet and shop worry-free by tapping your smartphone at checkout.

With the added layer of biometric authentication and encryption, mobile wallet ensures that every transaction is secure and confidential.

Compatible with Apple Pay®, Google Pay™, and Samsung Pay®3

Stay in control of your debit card

With financial fraud and identity theft on the rise, it’s only natural to worry if it will ever happen to you or your loved ones. Thankfully, it’s now possible to protect yourself from fraud while strategically managing your family finances, using a brand new feature in the MIT FCU mobile app called Card Control.

The new MIT FCU mobile app feature that lets you control debit card usage and spending on the go.

- Lock your cards, in an instant, for any reason

- Control transactions by category (gas, restaurant, online or mobile purchases, etc.)

- Receive alerts when your debit card is used, approved, or exceeds the transaction controls set by you

- Stay informed of potential fraud with alerts on attempted, declined transactions

- Get real-time balances for your accounts

Fraud Protection

A lost or stolen card is just one danger in today’s world, where identity theft, skimming, and other attacks are an unfortunate reality. Turning your debit card off when you’re not using it helps safeguard against fraud. When your card is “off,” no withdrawals or purchases will be approved. Transaction controls that allow your debit card to work only in specific locations or geographic areas, add another layer of protection. And real-time alerts keep you informed when your card is used or declined.

Control Spending

If you’re trying to establish or stick to a budget, Card Control can help there, too. Set spending limits for general use or specify thresholds by merchant types, like gas, groceries, or retail stores. You can also establish these controls by location. The flexible app lets you quickly change these parameters anytime with your mobile device. Going on vacation? Holiday shopping? Simply update your transaction controls to fit your spending needs.

Get your credit score and more

Receive your credit score and more with an MIT FCU account. Just enroll through mobile and online banking.

- Get daily access to your credit score.

- Daily credit report monitoring.

- Financial checkup with detailed spending and cashflow overview.

- Credit score simulator to help plan how to improve your score.

Financial Wellness

MIT FCU's Financial Wellness Blog offers valuable financial tips on credit scores, debt management, budgeting, saving, mortgages, and much more.

Mobile Wallets in the Digital Age

Learn how the technology behind mobile wallets has revolutionized the way we send and receive payments.

Continue reading

How To Stay Safe With The Wallet Of The Future

Whether you’re an Apple fan or a Samsung supporter, mobile wallets are an efficient, secure way to pay.

Continue reading

All You Need To Know About Mobile Deposit

You can now check your account balance and transfer funds between accounts, all from the comfort of your home or while on the road.

Continue reading