The Importance of Credit Health

Your first car at 21, your first home in your 30s, that trendy RV you plan to take cross-country in retirement… Don't forget the other major expenses along the way: Family vacations, household improvements, helping children with hefty tuition bills, perhaps even paying for a wedding. I've yet to meet anyone who can pay cash for life's major expenses. With most car purchases comes an auto loan. With the purchase of a home comes a first mortgage and – in many cases – a second mortgage or a HELOC years down the line. The list goes on: Education loans for school, increased credit card usage in planning a wedding or a significant vacation.

Surely, everyone can relate to one of the above scenarios. It all seems overwhelming, but it doesn't have to be. So, where do I begin?

Someone getting close to paying off a vehicle while also inching even closer to home ownership has every reason to keep a close eye on their FICO Score. Similarly, someone aggressively paying down credit card debt will find much encouragement in regularly checking in on their FICO Score.

Everyone should make a habit of reviewing their credit health regularly. "Lenders report information at least once per month, and when the data is added to your report, it's likely to produce a new credit score" (Harzog)1. Some credit score tools within various banking apps allow you to refresh your score every 24 hours. Under that level of scrutiny, you won't see your score change often. According to Emily Gerson with Experian, weekly check-ins are likely the most advisable approach: "Your lenders may report to each bureau at different times. Billing cycles can vary between 28 and 31 days, and reporting schedules vary by lender … 2

This means you could theoretically check your score every week and see a different number each time – especially if you have multiple credit cards or other debt reported at different times each month."

Let's now discuss what goes into a "score" and what is considered a good score versus a score needing improvement. Furthermore, where can I find my Fico Score, so I can understand where I fall within the credit spectrum? The stand-alone Experian app is an excellent tool for all of this. At MIT FCU, we're making strides towards implementing an in-app credit score dashboard with innovative features like "Credit Goals." More to come on that front, but for now, the Experian app is a solid place to start.

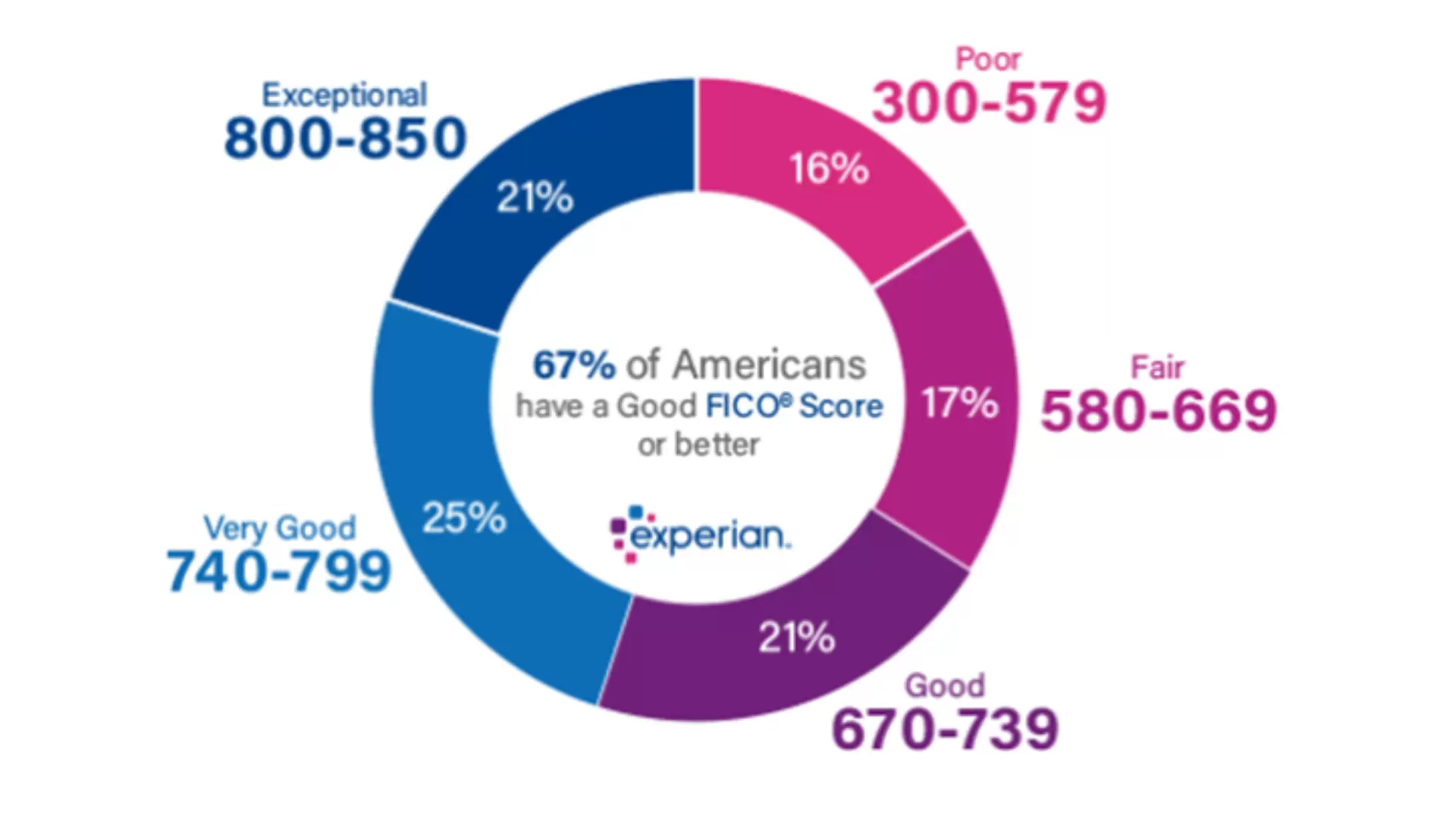

Writing for Experian, Jim Akin3 assigns the following "grades" to the following 3-digit Fico Scores:

FICO Scores

FICO Scores

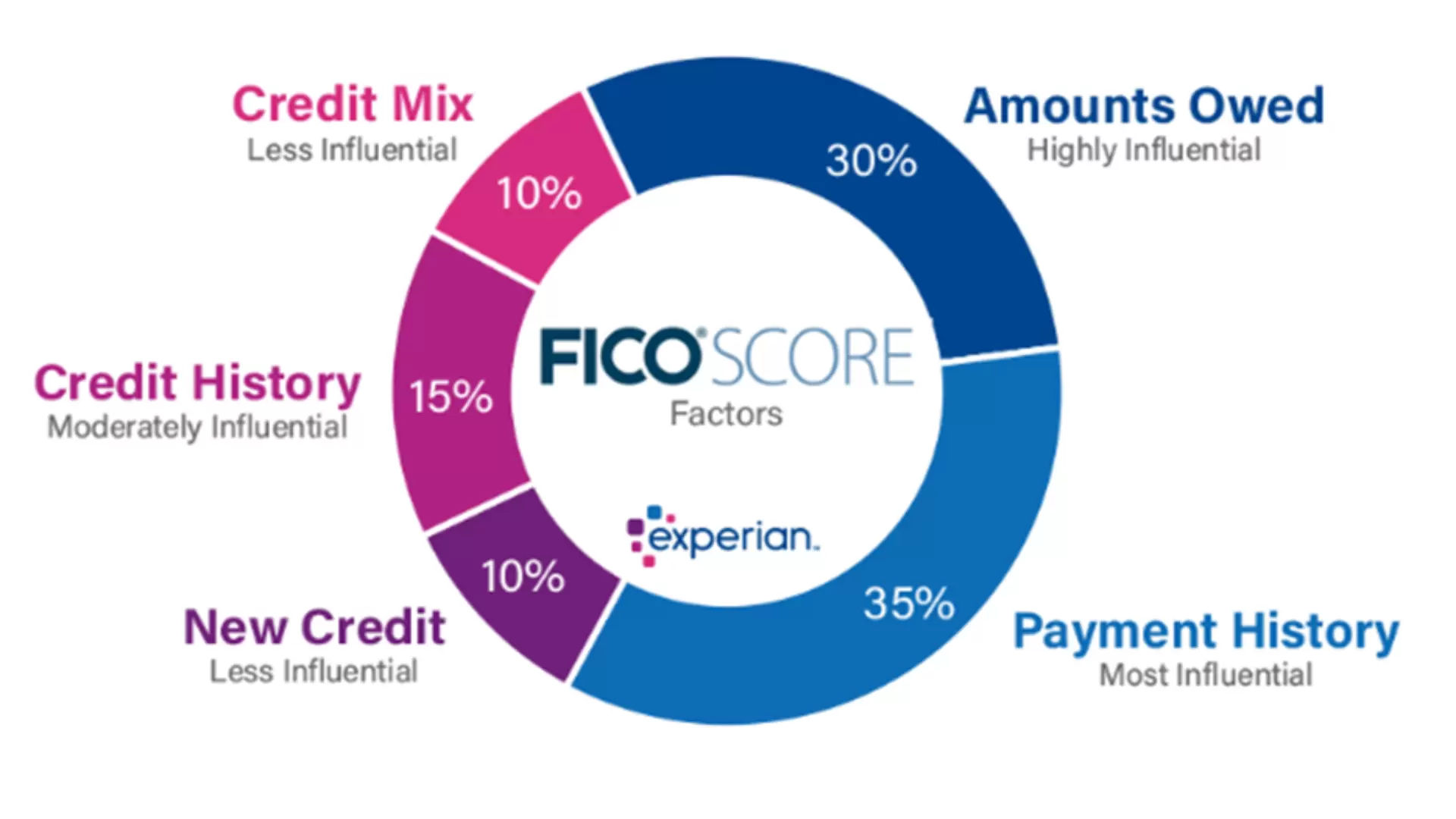

Let's explore what goes into calculating a score. Here's a breakdown according to Louis DeNicola and Experian3:

FICO Score Factors

Given the information above, it's clear that the quickest way to turn a credit score around involves exceptional payment history – satisfying at least the total amount of your "minimum due" and making these payments on time. The next best way to improve your score is to decrease your "credit usage." The Experian mobile app defines this notion of "credit usage" quite effectively: "Your credit usage is the amount of revolving credit you're currently using divided by the total amount of revolving credit you have available. In other words, it's how much you currently owe divided by your credit limit." A credit usage figure to strive for is no greater than 30% (Dieker)4. This figure won't be reached overnight for borrowers with overwhelming credit card debt; in fact, it might take several years to get there.

Many members of society face a devastating degree of credit card debt. For these individuals, it begins with getting this credit usage figure below 100%. From there, shave off another 5% of credit usage monthly or every few months. Begin swiping the debit card rather than the credit card and build on these positive habits. Create a budget using the Money Management tool within e-Branch and the MIT FCU mobile app! In addition to this budgeting service, we offer our members multiple loans that help repair weakened credit and help members with zero credit establish credit.

More info regarding these options here: Personal Loans - MIT Federal Credit Union (mitfcu.org) Improving one's credit health must always begin with an understanding of their current condition. Where are you now, and where do you want/need to be?

The road ahead surely involves major financial decisions and life-changing purchases for many readers. Ensure you understand your credit health and – if your condition needs improvement – make those constructive changes sooner rather than later.

Stay tuned for an upcoming article where I share some personal tips and tricks that may free up some money for you – money that can be used to pay down debt, fund a hobby, or finance a vacation.

References

1Harzog, Beverly. "How Often Do Your Credit Score and Credit Report Update?" U.S. News and World Report, 28 Dec. 2022.

2Gerson, Emily Starbuck. "When Do Credit Card Payments Get Reported?" Experian, 22 Mar. 2021.

3Akin, Jim. "What Are the Different Credit Score Ranges?" Experian, 23 June 2020.

4Dieker, Nicole. "How Much Available Credit Should You Have?" Bankrate, 12 July 2023.

« Return to "Blog"

How To Stay Safe With The Wallet Of The Future

Whether you’re an Apple fan or a Samsung supporter, mobile wallets are an efficient, secure way to pay.

Debt Consolidation: Not a Silver Bullet, But Still a Good Idea

Using a personal loan to refinance your existing debt can make your debt more manageable.

The Road to Building Credit with a Credit Union

Here's how you can get your credit rating going in the right direction.