Serving MIT Alumni

MIT FCU is proud to support our MIT Alumni community for their financial needs.

Serving MIT Alumni

MIT FCU is proud to serve MIT's worldwide community. Whether you're looking to grow your savings, refinance that student loan, or find an easier way to bank, your alma mater's own financial institution is here to help.

Alumni choose MIT FCU for:

- Competitive rates and terms

- A community of MIT alumni

- Customizable student loans

- Lifetime membership

Supporting your alumni community

You worked hard to earn your MIT degree, and today, you're part of an amazing alumni community finding ways to make the world a better place. Why not tap into all of the benefits of being part of the global MIT network?

MIT Federal Credit Union proudly offers membership to alumni, their families, and their housemates.

Additionally, when you choose MIT Federal Credit Union as your financial partner, in addition to great rates and products, you support the Alumni Association and its programs, too.

MIT FCU offers more than just a great rate

Certificates

Certificates offer a competitive, steady dividend rate for a fixed length of time and are best for money you don't need to access for a while.

- Dividends that are compounded daily and paid monthly

- No monthly fees

Home Equity Lines & Loans

Use the money you've already paid into your home51 for renovations, college tuition, unexpected emergencies, and more. Additionally, refinance an existing home equity loan or line (HEL/HELOC) to get a lower rate, access to more funds, or use funds towards purchasing another house53.

High Yield Savings

Our High Yield Savings Account can help you achieve your financial goals. If you want easy access to your money at a high-interest rate, a High Yield Savings Account could be a great fit.

- No monthly maintenance fees

- $500 minimum balance to earn dividends

Personal Loans

Avoid putting purchases on high-interest credit cards and discover what a fixed rate and low interest can do for you.

- Choose between a variety of loan options

- Borrow up to $50,000

- Choose from terms between 12 and 60 months

Begin with a savings account

A savings account (called a savings 'share' account) with a $5 minimum balance is required to establish and maintain membership. That $5 represents your ownership share in the Credit Union because once you become an MIT FCU member, you also become an owner.

To open you will need:

- Social Security number*

- Driver’s license or government ID

- Current home address

- Credit card or bank account and routing number to fund your account

Note: You’ll need these for any joint owners you’d like to add.

*If you don't have a social security number, you can still apply.

Benefits for the whole family

Immediate family such as parents, siblings, children, grandparents, spouses, and those living in your household can become members. This means your loved ones can enjoy the same great rates, personalized service, and financial benefits that you do.

Meet Kenny: VP, Member Experience

"People Helping People means that I get the opportunity and privilege to help our members achieve their goals, whether it be to buy their first car, their first home, or to assist them in times of need. Our products and services allow us to walk with our members through every stage of life. At MIT Federal Credit Union, we are People Helping People!

When I'm at home, my favorite past time is cooking, and I love to prepare dishes passed down to me by my grandmother.”

Community About MIT FCU

Bank when and where you want

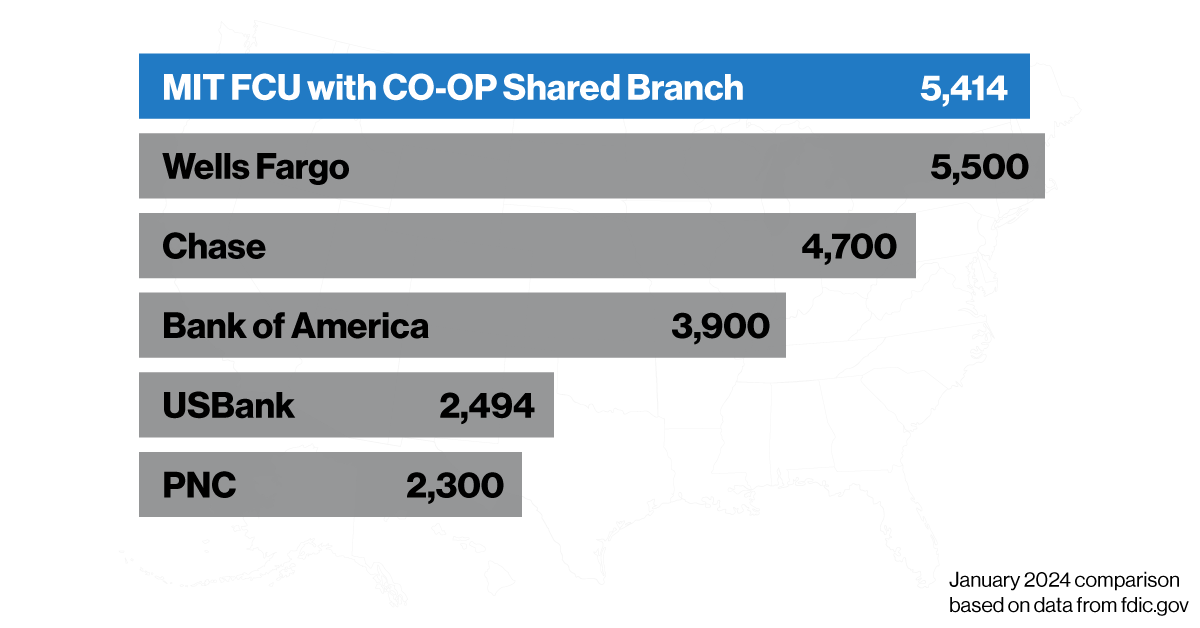

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4

Financial Wellness

How Much Should I Keep in My Checking account?

Here are three reasons you want to keep your checking account well-padded at all times.

Continue reading

Make the Most of Your Tax Refund

Here are three smart ways to put your tax refund to work for you.

Continue reading

The Importance of Being Financially Fit

Are you ready to stretch those financial fitness muscles? We hope so, because it’s time to get financially fit!

Continue reading

The Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.