Our Leadership Team

MIT Federal Credit Union is guided by our Executive Leadership team, Board of Directors, and Supervisory Committee.

Leadership

MIT Federal Credit Union is a not-for-profit financial institution owned by our members and guided by our Executive Leadership team, Board of Directors, and Supervisory Committee.

Executive Leadership

Rui F. Domingos

President, Chief Executive Officer

Lisa Rose Mandel

Chief Operating Officer

Dmitriy Banar

Senior Vice President, Lending

NMLS #21915

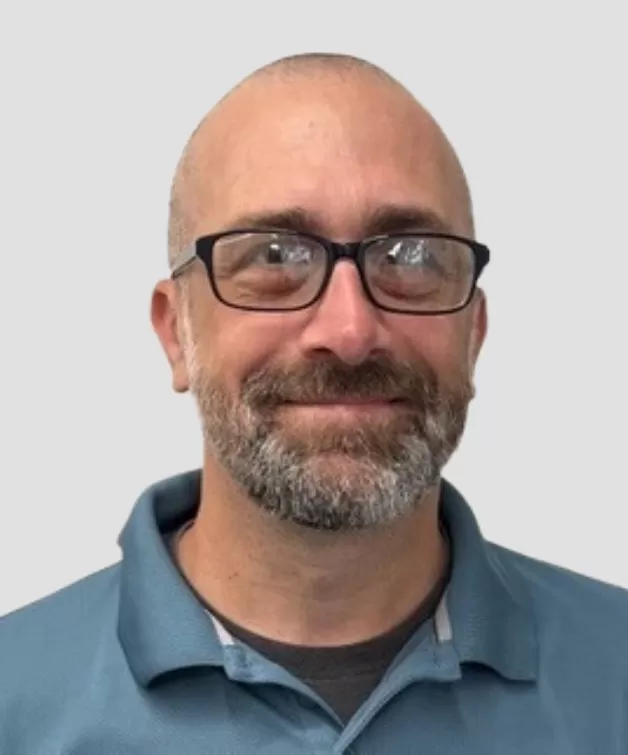

Matthew Goldsmith

Senior Vice President, Member Experience

John Billings

Vice President, Marketing

Jill Finnegan

Vice President, Finance

Paula Silva Lieske

Vice President, Loan Administration & Asset Management

NMLS #1507257

Kenneth Holgersen

Vice President, Member Experience

Brian Robichaud

Vice President, IT & Cybersecurity

Volunteer Board of Directors

Steven Winig

Board Chair

Compensation (non-voting), IT Steering

Executive Director, Technology and User Services, Novartis Institutes for BioMedical Research

John Kendall Nowocin

Vice Chair

ALCO, Compensation Chair, IT Steering

CTO and Co-Founder, Cool Crop

Robert M. Dankese

Treasurer

ALCO Chair, Functions Chair

Retired MIT Employee, 35 Years of Service

John Gianfrancesco

Secretary

Governance, Nominating

Sr. Principal, Finance, Draper Laboratory

Clinton Blackburn

Director

Compensation, Nominating Chair, IT Steering

Software Engineer, Stripe

John M. McDonald

Director

Compensation, Governance Chair

Director of Business Services and Technology, MIT Division of Student Life

Vipul Bhushan

Director

ALCO, Supervisory, Functions

Managing Director, State Street Private Markets

Jay Steven Fridkis

Director

ALCO, Functions

Sage Intacct Solution Architect, CFGI (Boston)

Alexis Zhu

Director

ALCO, Governance, Nominating

Jehana Ray

Associate Director

ALCO

Supervisory Committee

Stephen W. Boyer

Chair

Chief Technology Officer, BitSight

Jordan B. Lewis

Secretary

Business Analyst, MIT

Theresa Howell

Member

FMLA & LOA Administrator, MIT Human Resources

Karon McCollin

Member

Manager of Financial Systems in the VP for Finance Office, MIT

Vipul Bhushan

Director

ALCO, Supervisory, Functions

Managing Director, State Street Private Markets

Interested In Getting Involved?

MIT Federal Credit Union's Nominating Committee is seeking credit union members who are interested in serving on the Board of Directors.

The Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.