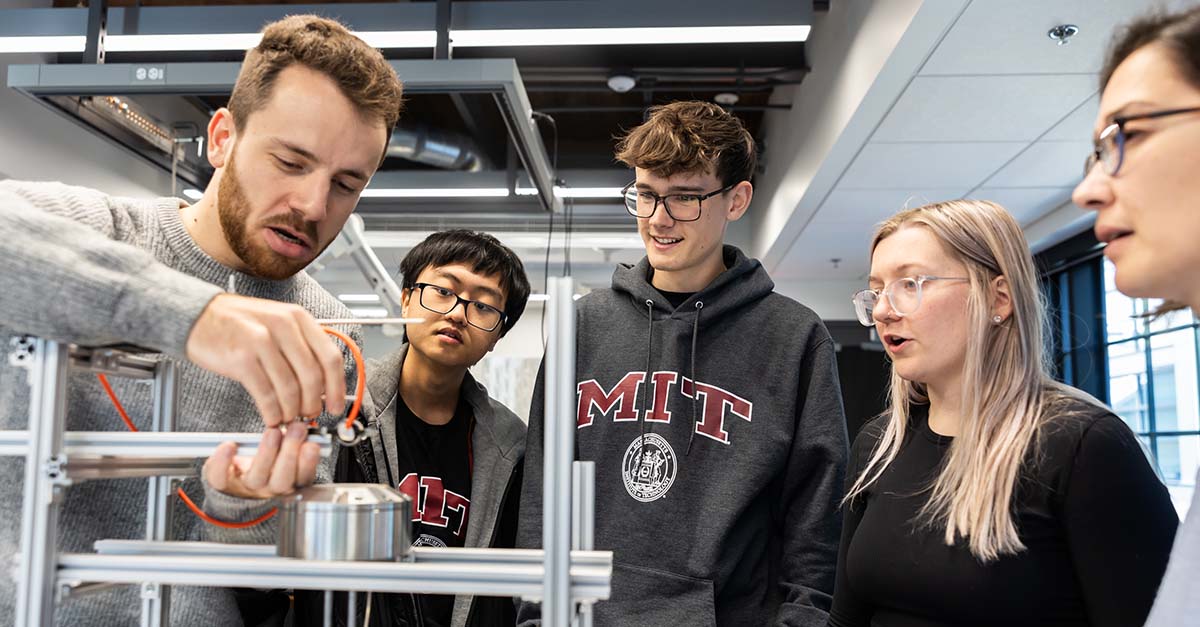

Choose smarter Student Loans

Invest in your education with a Student Loan. We're here to help you reach your academic goals.

We're here to help you reach your academic goals.

MIT Federal Credit Union understands how important affordable education is. That's why we partnered with Student Choice to provide guidance and flexible solutions for your undergraduate education.

Student Loan Resource Hub

With information ranging from college planning to negotiating for more financial aid, our partner, Student Choice, is full of helpful information.

Apply now, borrow later

Determining your college funding needs may be a challenge. Even if you're unsure of the college you'll be attending or the loan you'll need, you can establish your private education line of credit today.

Personalized support

Our College Access and Repayment Counselor can provide personal, one-on-one consultation for all financial aid questions for parents, students, and college graduates entering loan repayment.

Don't let loan payments hold you back

- Apply once, then make multiple draws throughout your college career.

- An annual credit review is performed each May to authorize future draw requests.

- Apply with a co-applicant/co-guarantor to improve chances of approval and possibly get a better rate.

Tuition Assistance Loan

Are you anticipating a tuition reimbursement by your employer? A Tuition Assistance Loan lets you get the cash you need now to take the class, then pay it back when you get reimbursed.

- Loan amounts up to $12,500

- Repay within 12 months of reimbursement

- Optional co-borrower/guarantor to assist

- No collateral needed

- No processing or service fees

Refinance your student loan

MIT FCU offers the option to refinance and consolidate your current private and federal student loans (including PLUS loans) into one manageable loan. You may find a better rate while consolidating your payments into one manageable loan.

| Product | Term | APR1 | Estimated Monthly Payment per $1000 | Apply Now |

|---|---|---|---|---|

| Personal Loan + Co-Application/Guarantor Loan | 12 Months | 8.50% | $87.21 | Apply now |

| 24 Months | 8.75% | $45.47 | Apply now | |

| 36 Months | 9.00% | $31.80 | Apply now | |

| 48 Months | 9.25% | $25.00 | Apply now | |

| 60 Months | 9.50% | $21.00 | Apply now | |

| Tuition Assistance Loan | 12 Months | 8.50% | $87.21 | Apply now |

| Overdraft Protection Line of Credit | Line of Credit | 10.00% | N/A | Apply now |

| Fuel Assistance Loan | 12 Months | 6.50% | $86.29 | Apply now |

| Express Loan | 12 Months | 18.00% | $91.67 | Apply now |

| Accessibility Lifestyle Loans | 12 Months | 8.25% | $87.09 | Apply now |

| 24 Months | 8.50% | $45.45 | Apply now | |

| 36 Months | 8.75% | $31.68 | Apply now | |

| 48 Months | 9.00% | $24.89 | Apply now | |

| 60 Months | 9.25% | $20.88 | Apply now | |

| Rental Assistance | 12 Months | 8.25% | $87.09 | Apply now |

| 24 Months | 8.50% | $45.45 | Apply now | |

| 36 Months | 8.75% | $31.68 | Apply now |

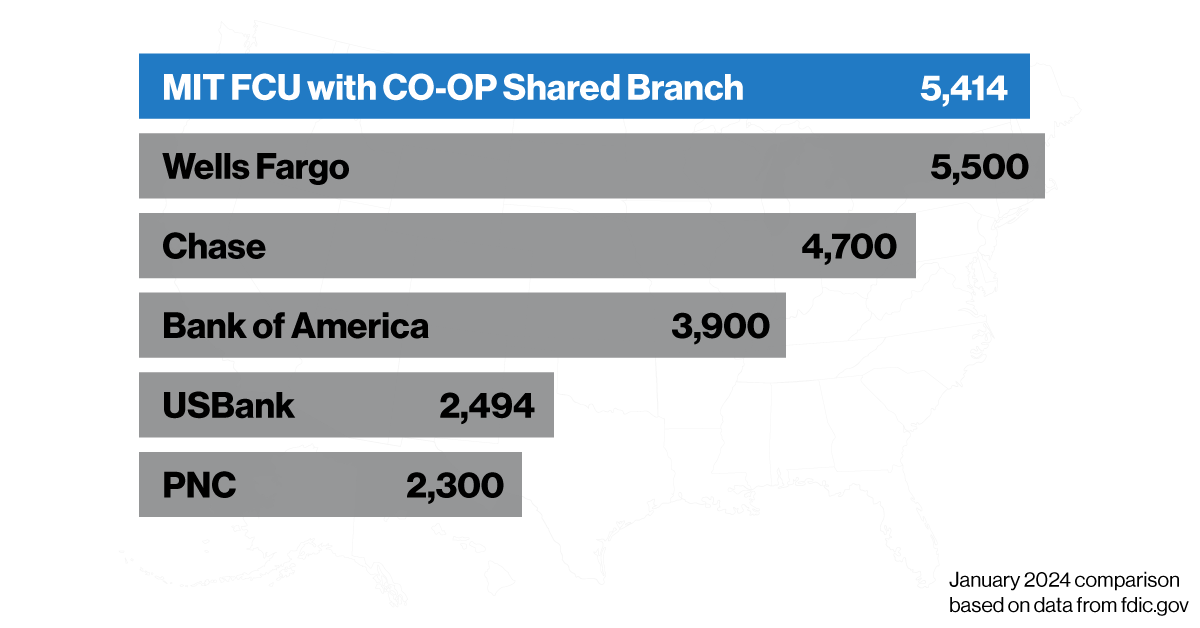

The Credit Union Difference

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

Financial Wellness

Our Financial Wellness Blog offers practical tips, insights, and guides to ensure you’re taken care of every step of the way. To us, financial wellness goes beyond the numbers. We provide the tools and knowledge to reduce stress, build confidence, and foster smarter financial decisions.

The Benefits of a Credit Union vs. Bank

The benefits of a credit union go beyond just financial perks—they also extend into community support and empowerment.

Continue reading

The History of Credit Unions

Credit union history is still in the making. Become a part of it and benefit from our highly personalized service.

Continue reading

Daily Habits That Lead to Long-Term Financial Wellness

The foundation for long-term financial wellness is built on small, consistent choices you make every day.

Continue readingBank when and where you want

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4