STUDENT TALK Adulthood: Renting and Loans

I’m going to be frank with you. As I write, I’m a senior heading into my final semester as an undergrad. On top of all the complications COVID-19 presented, I'm beginning to worry about becoming an independent adult at the end of the semester. I write this to educate others, present and future, who will no doubt recognize the feeling, but also as a reminder to myself of the knowledge I've attained, but seem to lose a grasp on when adulting needs rear their heads. Note to self: Keep the following in mind as I transition out of undergrad life. Note to my readers: Consider these tips and resources, and refer to them often as you start on your own adulting path.

Shelter: Finding a Place to Live is Important

Whether you’re looking for off-campus housing or figuring out where you want to live post-grad, the process of looking for housing outside of MIT is a tedious one. I'm sure it's the same regardless of where you're living. On top of the logistics of finding roommates, nailing down a location, and virtual touring, finding a new home has several financial considerations that cannot be ignored.

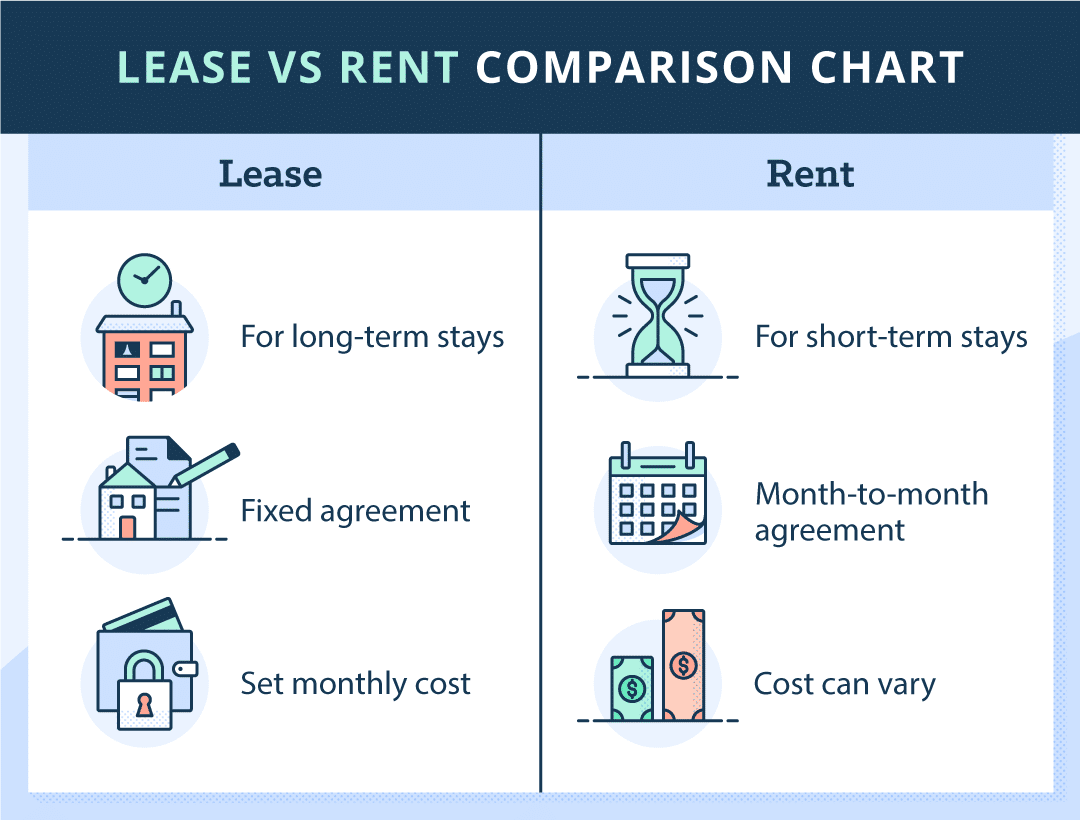

Leasing vs. Renting - Is there a difference?

If you’re not staying in your childhood home, hopping between Airbnb’s (which is fun for a while but has it's own costs issues), or staying on-campus, finding a place to rent is probably your number one focus whether as an undergrad and in your post-grad life.

A standard lease agreement is typically a year (can be shorter or longer depending on the landlord). Rent will be a fixed cost for the term of your lease and will be outlined in your lease agreement. In contrast, a rental agreement is typically for short-term arrangements, such as staying in a city for a couple months for an internship. It may be an at-will agreement allowing you or your landlord to cancel at any point. This is a bit iffy when it comes to renting a place while you're in school, or working a permanent job, but great if you're doing a summer project or special internship. The monthly rental cost may vary, allowing more flexibility for the tenant. Some parts of the country are more likely to offer tenant-at-will than lease. But keep in mind, with lease, your landlord cannot terminate or change the rent amount until the end of the lease unless you've broken the terms. With a rental agreement, written or verbal, the agreement can be terminated with just a single month's notice, and rent can be increased at any time with appropriate notice.

Understand who pays for utilities. In addition to the cost of rent, it’s always good to check whether utilities (such as water, electricity, air conditioning, heating, and internet access) will be included with the rent. If you’re living with roommates, be sure to discuss how you’ll split up the living expenses and bills. Will you take turns buying groceries? Will you pay an equal share of all utility bills? Should you appoint one person to keep track of the finances and hunt down people who don’t pay their fair share? If you don't decide these things ahead of time, don't be surprised if there's suddenly a shortage of food, or you're receiving notice of electric being shut off. Make sure everyone agrees to the arrangement and has access to funds to make timely payments. Student Loan Hero recommends a number of apps to assist in the whole splitting the expenses piece of the puzzle.

Signing the Lease

There is usually a security deposit involved when you're signing a lease. If you have pets there may also be a pet deposit, or even an additional amount to be included with the rent/lease payment each month. Security deposits and pet deposits show your intent to move in and maintain the property during your stay, and will be retained to pay any damages during your stay. Any fees added to the rent each month will usually not be refunded. A standard security deposit is equivalent to first and last month’s rent, plus a cleaning/maintenance fee. The deposits and any process for receiving a refund, should be outlined in your lease or rental agreement. Other details you may look for before signing a lease:

- Is subletting allowed if you cannot stay there for the entire lease period?

- Are you planning to bring/adopt a pet? Are they allowed and are there any restrictions? Check on whether a pet deposit is required. Having a pet when they're not allowed is a definite broken lease agreement and can result in being thrown out and losing all your deposit funds.

- Are you responsible for maintenance? If you are, make sure you've got the tools, and understanding of what you can and can't do. Do you need to call for plumbing repairs, are you supposed to mow lawns or shovel snow?

- If you want to paint or make improvements, is it allowed and will the landlord reduce your rent based on your costs for that work. Don't assume.

Another thing to consider is renters insurance (a.k.a. tenants insurance, HO-4 policy). It’s a smart purchase and depending on the coverage, may assist with:

- Your personal possessions in the case of theft, fire, or other similar instances of peril

- Your hotel stay and food costs if you get displaced due to a disaster

- Liability costs if anyone becomes injured while in your residence.

Nerdwallet offers a comparison of companies for renters insurance. Unfortunately, renters insurance will not cover damages from flooding, earthquakes, or infestations. But check with your landlord because they may also have insurance for some coverages for tenants.

Breaking the Lease

If you have to break a lease, make sure you read the terms in the lease, understand the consequences, and know your rights. Make sure you give your landlord ample heads up and prepare to lose your security deposit. In some cases, if a new tenant can be found fast enough, the penalties may be waived or reduced. Otherwise, you may have to pay a few months’ rent or the rest of the rent owed for the lease period. However, depending on state laws, you may be able to break the lease without consequences if you’re dealing with exceptional circumstances.

Subletting

An alternative to breaking the lease is subletting, also known as subleasing. This is when the tenant on the original lease rents out the residence to a new subtenant, who will be responsible for the rent and taking care of the property. This might be an option if you plan to leave the residence for a short period, such as to study abroad for a semester. Some states may also have laws around subletting, so communicate with your landlord and check what those laws are before assuming subletting is your answer.

Creating a written sublease agreement, and finding a reliable subtenant isn't unusual. But make sure the person you sublet to understands the responsibilities they will be taking on. That original lease is in your name, and you are ultimately responsible for the space. Some common MIT practices for finding subtenants are to post on Facebook and dormspam.

Buying a Home

As a student or recent grad, buying a home may seem like a far-off milestone. I’ll emphasize here that it's important to be in a financially secure position before looking into buying a home. But it is a possibility for some. To avoid overloading you here too much, I've separated out homebuying in its own blog post - Homebuying 101.

Paying Off Loans

Over a lifetime, it's inevitable that you'll end up dealing with some form of a loan. Whether it’s paying off tuition with student loans or taking out a mortgage loan to buy a house, with large sums of cash come agreements and terms that are important to understand. Better get used to that idea.

Interest

This is essentially the cost of borrowing someone else’s money. The "principal" loan amount is the agreed-upon amount the borrower gets from the lender. The interest is calculated as a percentage of the principal. Interest rates for loans are usually given in the form of an annual percentage rate (APR). Depending on the loan specifics and related fees, you may see a lower or higher APR. That's because the APR includes the costs of the loans (fees, closing costs, etc). This is to allow you to compare loans between lenders. Multiple lenders may charge the same interest rate, but their fees may vary. The APR is where you'll be able to truly compare without needing a big long list (hopefully not TOO long) of additional costs associated with the loan. When you’re depositing money into a savings account (essentially lending your money to the financial institution), the interest you earn on that money is referred to as the annual percentage yield (APY) rate. Essentially how much the bank or credit union is paying YOU for your money - how much your money will yield.

Payment Plans

The payment plan’s terms are made between the borrower and the lender at the beginning of the agreement. Typically, payments are made in monthly installments, meant to pay off the principal amount you borrowed and any interest built up during that time. An amortization table is a handy tool to help you keep track of payments, how much you’ve paid, and how much you still owe.

Depending on the loan, payments will be made in arrears or in advance. A payment made in arrears is a payment made at the end of a determined period or after a service has been given. For example, you pay a utility bill for the preceding month’s use of utilities. A payment made in advance is made at the beginning of a determined period. A common example is rent, where you pay the amount for the upcoming month of living in the residence.

One key thing to note is that the monthly amount you have agreed to pay is probably the minimum amount you have to pay, meaning you can pay more if you want/have the means. Paying more than the minimum allows you to save money from interest and resolve your loan debt sooner. But check with your lender. Paying a loan of early can result in a penalty. It's all in the agreement and should be disclosed upfront by your lender. If you still want to pay a loan early, crunch the numbers to make sure you won’t actually be paying more money by paying off that loan.

Aside from that, make sure you don’t miss payments. Missing payments can cause your loan to default, which usually drops your credit score, results in additional interest and fees being accrued, and/or causes your debt to be sent to a debt collection agency. Also, the ownership of a property, such as a car or home, falls with the lender until the loan is completely paid off. That's right, you don't actually own a car or a house or any other item given as collateral until you've paid off the loan. This is why they can repossess an item for non-payment. It acts as collateral pledged against your repayment of the loan. If you stop paying the loan and make no arrangements with the lender to do so, foreclosure or repossession, and loss of the property pledged as collateral may occur.

Predatory Lending

You’ve probably heard the term loan shark before. That sleazy, uncomfortable characterization is unfortunately not an uncommon occurrence in the real world. It’s important to keep an eye out for unfair or abusive loan terms from predatory lenders.

Some common predatory lending practices include charging high fees, assigning loans with high-interest rates, not being transparent about the process, and threatening violence for missed payments. Negative amortization and even interest-only payment options can also be seen as predatory depending on the circumstances. The goal of predatory lending is for the lender to continually make a profit by leeching off of the borrower, so it’s to their benefit to find ways to continually make the borrower indebted to them.

Predatory lenders use aggressive sales tactics to make their loans seem enticing and agreeable, essentially setting a trap for the unsuspecting borrower. They tend to target communities that are less educated, lower-income, lacking options due to their low credit scores, and financially vulnerable in other ways. As I mention in my banking article, these communities tend to be people of color. More specifically, Black and Hispanic Americans are more disproportionately affected by the racial wealth gap. Thus they are more likely to be shoehorned into interacting with predatory lenders.

How can you prevent yourself from falling victim to predatory lending? Well, reading this article is a good start! Continue educating yourself, and don’t be afraid to shop around if you find yourself in need of a loan or feel like you're getting pressured to borrow. The more options you find for yourself, the more likely you’ll find a lender with more equitable, fair lending terms.

Another good first step is finding a reputable, friendly, and welcoming financial institution to do your banking with. You can find some that will offer home buying seminars and special products and services to support those that may have credit issues or need to establish a history of credit.MIT Federal Credit Union offers homebuyer seminars at various times during the year, including during IAP, and they bring in realtors, home inspectors, and mortgage people so you can get your questions answered openly and honestly.

For further reading, Investopedia has a nice article that details the different kinds of predatory lending tactics and loans that you may encounter. The National Credit Union Association (NCUA) also has a related page on the existing laws that protect you from predatory practices.

And that’s it for now! I commend everyone that has made it this far, and I hope this acts as a foundational guide for leasing, renting, and loan management.

If you’re unsure how you can live day-to-day life affordably, I would like to point you to the handy tool thrifty, developed by MIT student group CASE (Class Awareness, Support, and Equality) for crowdsourcing affordable living resources from the MIT student community. The ARM (Accessing Resources at MIT) Coalition and S^3 (Student Support Services) also offer student resources. And, of course, MIT Federal Credit Union will be around if you need advice on financial matters!

Sites used for research:

Forbes Advisor

Investopedia

Moving.com

NerdWallet

Rent.com

Student Loan Hero

« Return to "Blog"

STUDENT TALK What if my Credit Score is Zero?

The following 5 simple steps can get you on the path to good credit and the ability to successfully apply for loans or credit cards (and hopefully get approved!).

STUDENT TALK 5 Key Factors About Credit Cards

Before you apply for that card, get comfortable with the following key factors.

STUDENT TALK Adulthood: Renting and Loans

Consider these tips and resources, and refer to them often as you start on your own adulting path.