Debt Consolidation: Not a Silver Bullet, But Still a Good Idea

Using a personal loan to refinance your existing debt can make your debt more manageable. You’ll have one monthly payment at one interest rate instead of many smaller bills due on different days of the month.

Have I fixed the debt problem?

Think about why you’re in debt. If a medical bill, job loss or some other temporary hardship describes your situation, the fact that you have a job or have paid the medical bill means you’ve solved the problem that caused the debt in the first place.

If, on the other hand, you accumulated debt by overspending on credit cards, a debt consolidation loan may not be the answer just yet. First make a budget you can stick to, learn how to save and gain responsibility in your use of credit. Getting a debt consolidation loan without doing those things first is a temporary solution that can make matters worse.

Can I commit to a repayment plan?

If you’re struggling to make minimum monthly payments on bills, a debt consolidation loan can only do so much. It’s possible that the lower interest rate will make repayment easier, but bundling all of that debt together could result in a higher monthly payment over a shorter period of time. Before you speak to a loan officer, figure out how much you can afford to put toward getting out of debt. Your loan officer can work backward from there to figure out terms, interest rate and total amount borrowed.

If you’re relying on a fluctuating stream of income to repay debt, it may be difficult to commit to a strict repayment plan that’s as aggressive as you like. You can still make extra principal payments on a personal loan, so your strategy of making intermittent payments will still help. You just can’t figure them into your monthly payment calculation.

Is my interest rate the problem?

For some people, the biggest chunk of their debt is a student loan. These loans receive fairly generous terms, since a college degree should generally result in a higher-paying job. Debt consolidation for student loans, especially subsidized PLUS loans, may not make a great deal of sense. You’re better off negotiating the repayment structure with your lender if the monthly payments are unrealistic.

On the other hand, if you’re dealing with credit card debt, interest rate is definitely part of the problem. Credit card debt interest regularly runs in the 20% range, more than twice the average rate of personal loans. Refinancing this debt with a personal loan can save you plenty over making minimum credit card payments.

Will a personal loan cover all my debts?

The average American household has nearly $15,000 in credit card debt.

If you have more than $50,000 in credit card debt, it’s going to be difficult to put together a personal loan that can finance the entire amount. It’s worth prioritizing the highest interest cards and consolidating those instead of trying to divide your refinancing evenly between accounts. Get the biggest problems out of the way, so you can focus your efforts on picking up the pieces.

Debt consolidation doesn’t work for everyone, but it can do wonders for many people. The ability to eliminate high-interest debt and simplify monthly expenses into one payment for debt servicing can change a family’s whole financial picture. Gather your account statements and your paycheck stubs, and head to MIT Federal Credit Union today! For more help, contact us to get started on a personal loan from MIT FCU.

« Return to "Blog"

- Share on Facebook: Debt Consolidation: Not a Silver Bullet, But Still a Good Idea

- Share on Twitter: Debt Consolidation: Not a Silver Bullet, But Still a Good Idea

- Share on LinkedIn: Debt Consolidation: Not a Silver Bullet, But Still a Good Idea

- Share on Pinterest: Debt Consolidation: Not a Silver Bullet, But Still a Good Idea

Daily Habits That Lead to Long-Term Financial Wellness

The foundation for long-term financial wellness is built on small, consistent choices you make every day.

All You Need to Know About: Video Teller Machines (VTMs)

Cutting-edge technology that meets the banking needs of our members. Here’s what you need to know about VTMs.

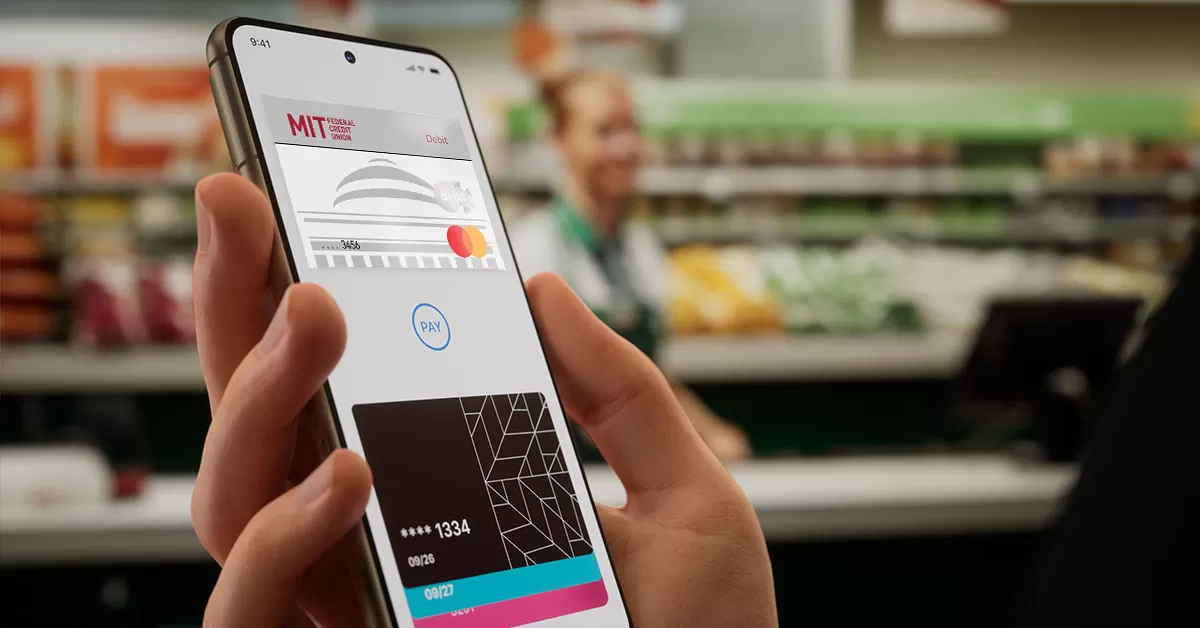

How To Stay Safe With The Wallet Of The Future

Whether you’re an Apple fan or a Samsung supporter, mobile wallets are an efficient, secure way to pay.