Your banking experience, seamlessly elevated

We're upgrading our core banking system for a smarter and more connected experience. The update will occur from Friday, October 31st, through November 3rd, 2025.

At MIT Federal Credit Union, we believe in more than just banking. We provide tailored financial solutions, care for our neighbors, and support local dreams.

We proudly celebrate 85 years of empowering our diverse community to grow, thrive, and achieve.

Rates as high as

Minimum daily balance required to earn APY is $500.00.

Minimum daily balance required to earn APY is $500.00.

We provide flexible solutions for your undergraduate education.

Learn more

Choose our Certificate options and grow your funds with confidence.

Learn more

You don’t have to re-apply to college every year – why should you have to re-apply for your student loans?

With an education line of credit from MIT FCU, you get built-in flexibility to borrow what you need, when you need it.

Even if you’re unsure of the college you’ll be attending or the exact loan amount you may need, you can establish your private education line of credit today.

Learn more Apply now

MIT Federal Credit Union will be undergoing a core system upgrade, which will provide enhanced service, technology, and security for our members. Core transformation is a significant change for the Credit Union, and our employees are working hard to make sure the transition is as easy as possible for our members.

MIT FCU's core transformation will take place from Friday, October 31st through Monday, November 3rd, 2025. During this time, account access will be unavailable.

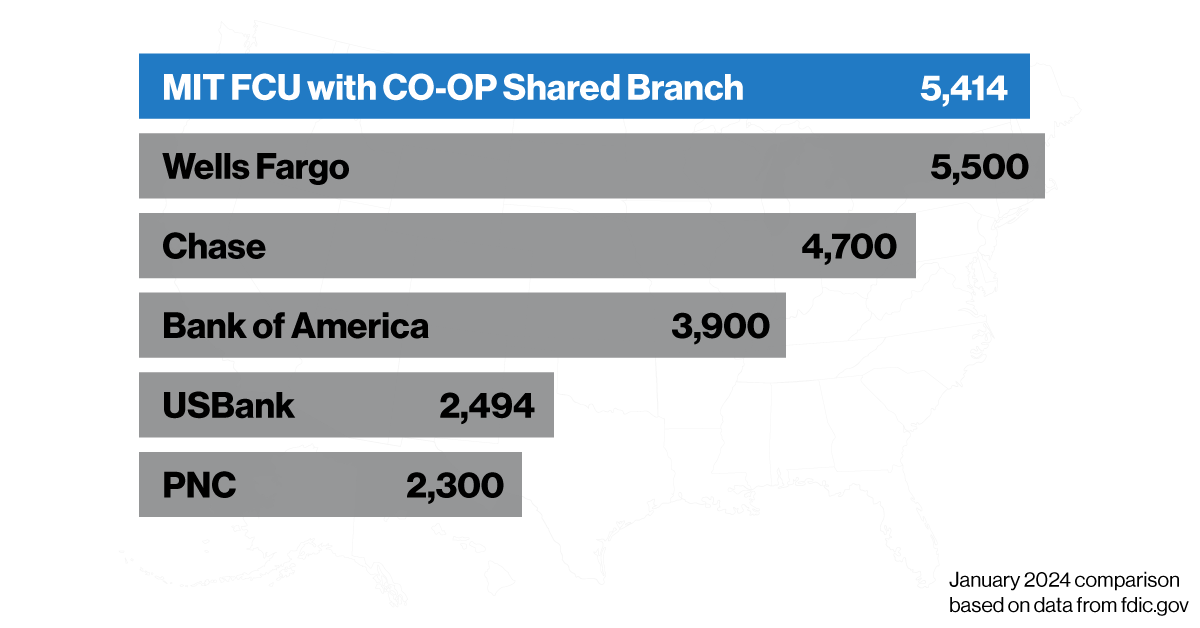

With mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4

"‘People Helping People’ means that I get the opportunity and privilege to help our members achieve their goals, whether it be to buy their first car, their first home, or to assist them in times of need.

Our products and services allow us to walk with our members through every stage of life. At MIT Federal Credit Union, we are People Helping People!

When I'm at home, my favorite past time is cooking, and I love to prepare dishes passed down to me by my grandmother.”

Community About MIT FCU

We are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

Be the first to hear about upcoming enhancements and important changes! We're constantly improving our systems to provide a smoother, more secure banking experience.