Beginner's Guide to Estate Planning: Protecting What Matters Most

Join us as we discuss appointing guardians for minor children, ensuring a smooth transfer of assets, and reducing the potential for family disputes.

At MIT Federal Credit Union, we believe in more than just banking. We provide tailored financial solutions, care for our neighbors, and support local dreams.

We proudly celebrate 85 years of empowering our diverse community to grow, thrive, and achieve.

Rates as high as

Minimum daily balance required to earn APY is .

Minimum daily balance required to earn APY is $500.00.

Enjoy Checking that earns interest and all the conveniences you deserve.

Learn more

Our Mortgage team handles everything in-house, ensuring an easy process for your loan.

Learn more

Earn more than your average Savings with our High Yield Savings Account.

Learn more

Effective May 1, 2025, when visiting a shared branch location with an out-of-state ID or driver's license you will be asked to utilize a new authentification method to confirm your identity.

This new ID verification system is used to further protect your identity and the security of your accounts.

Voice ID is an easy, fast, and secure way to verify yourself over the phone. Voice ID is automatically added to your account when you call MIT FCU.

Your voiceprint is stored with the same security as the rest of your identifying information. Your voiceprint is even more distinctive than a fingerprint, so it can't be imitated or faked.

Learn more Security centerWe are not a bank, and that's an advantage for our members. As a credit union member, here's how you benefit.

At credit unions, members are owners; we answer to them, not investors. Each member has equal ownership.

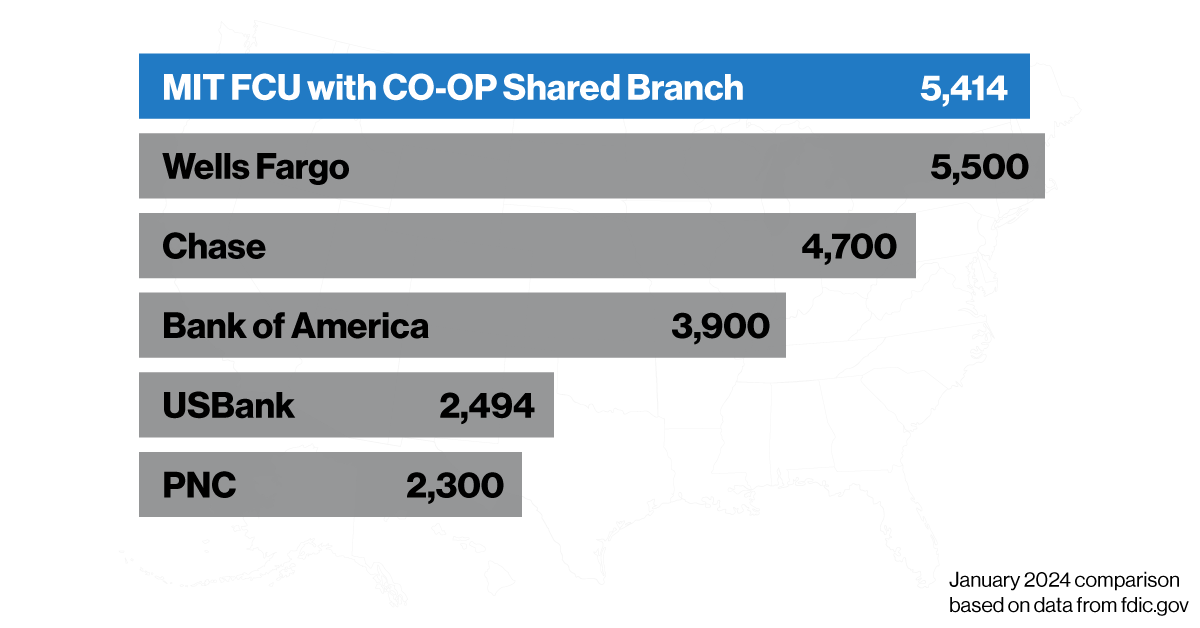

Thanks to the CO-OP branch network, you can access over 30,000 fee-free ATMs and over 5,600 branch locations nationwide.

Credit unions are not-for-profit cooperatives that give back to their members with great savings rates and lower loan rates.

Throughout the history of U.S. credit unions, taxpayer funds have never been utilized to rescue a credit union.

Credit union deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), a federal government agency.

MIT Federal Credit Union will be undergoing a core system upgrade, which will provide enhanced service, technology, and security for our members. Core transformation is a significant change for the Credit Union, and our employees are working hard to make sure the transition is as easy as possible for our members.

MIT FCU's core transformation will take place from Friday, October 31st through Monday, November 3rd, 2025. During this time, account access will be unavailable.

"For our team, People Helping People means earning our members’ trust by showing commitment, genuine interest, and integrity at any moment and in every single interaction. It’s not only about being in their shoes, it’s about seeing their situations through their eyes.

I love running, I run as much as I can. I love also writing Sci-fi, and some of my stories come to my mind while running, so the more interesting the plot, the longer the run. My family is everything to me, and there is no better reward than coming home after my daily activities.”

Community About MIT FCUWith mobile and online banking, two convenient branches on campus, access to over 30,000 ATMs, and 5,600 branches nationwide.

Download our highly rated mobile app!4